In school we were graded on every subject. You knew from term to term how well you were travelling by the teachers' and the school's standards. However in life, there is no report card as to how you're travelling as a worker, family member, home budgeter, or even a health report.

There are warning signs which you can look for to give us clues on each of these subjects. If you constantly get fired and move from job to job, this signals you are struggling as a worker. If nobody in your family wants to talk to you, this could indicate how well you fit in or not. If you know your doctor by their first name and where they have been on vacation for the last five years, your health might not be the best.

But what about home budgeting? Are you doing well or not? What grade would you give yourself if you had to assess your own performance? We have come up with ten questions you might like to answer. These should give you a clue as to what your home budgeting skills are right now. If you answer all these questions in the positive, this should tell you that you are on the right track. However, if a few of these questions are negative then you can give yourself a lower score. Be honest with yourself. Don't hold back; be your harshest critic. Only when you deal with the facts will you know what to do next.

You will become the teacher on this one. Rate yourself from A to F. Just like grades in school, A is a high pass, B is a good pass, C is satisfactory pass, D is a fail and F is a complete failure. Then at the end, give yourself a total score of the averages.

Please note, while these are not all the questions we could have asked, they do cover a lot of bases and should really give you an insight as to how you are travelling.

Question One: Are all your bills paid on time?

Do you make it a priority to pay before the due date thus avoiding late payment fees? Or are you at the opposite end of the scale; do you have an ongoing relationship with the companies calling you up looking for payments?

Why aren't you paying on time; because you forget or because you don't have the money? If you have the money but forget, you can give yourself a higher grade. But if it is because you have to borrow money to pay back money and are juggling debts, give yourself a lower grade. Perhaps even an F.

In my experience, most people have the money but they just forget. They don't make it a high priority on their "to do" list. They incur fees and reminder notices just through forgetting. If this is the case, you can quickly turn a low grade into an A by shifting your focus.

Start paying bills as soon as they arrive, don't put them in the "to do" pile. Or, you can go to all your billers and set up direct debit - the easy way to pay. Now each time a bill comes in, you can safely file it away, knowing it will get paid.

Question Two: Are you a big emotional spender?

This can be hard to quantify, however just think about the last 30 days. I want you to think about all the products you have purchased; both big and small purchases. Which of these did you really need? And which did you really WANT. Wants and needs are two completely different types of purchases. Do you have a bunch of trinkets around the house you just purchased on a whim? Or when you go to the shops are you like a robot, programmed to only purchase what you have on your shopping list? Emotional spending is the opposite of rational spending.

Humans are funny creatures. We make emotional decisions all the time, even though some of those decisions are not good for us. Look at car adverts. Most car adverts don't advertise the car; they show a family driving in the hills or to a picnic. They are suggesting that you look at all the fun you will have in this car. They are tapping into your emotional side, not your rational side. They want you to get a great feeling when watching the advert or thinking about the car. And they do it because it works.

Emotional spending is an interesting subject. The one thing we come across time and time again is parents unable to say no to their children. They want their kids to have whatever they want, whenever they ask.

This is emotional spending. They feel good when they provide what their kids want. The rational parent/ spender has to say no to the children. While in most cases this is a better purchasing decision and better for the budget, it brings on bad feelings.

Now think about all the big purchases you have made over the past 12 months, anything over $1000. Did you do your homework on the purchase e.g. looking at reviews on the internet? Did you shop around for the best price? Did you check your budget to see if you could afford it? And the big question, did you really need it? If you didn't need the product, it was probably an emotional purchase.

This mark involves being honest with yourself.

Question Three: Do you know how much money you are worth right now?

No, we are not talking about how much money you have in your bank account. We are talking about if you sold everything and paid off all your debts. What would be left over? This is an interesting question.

Most people have no idea what they are worth if you asked them. At least once a year you should take stock of yourself. Do a quick calculation as to what your total worth is. Plus keep it on record, so the following year at the same time you can see if you are going forward or backwards.

Your goal should be to increase this overall value each year.

Every stock exchange listed business must once a year send out a detailed financial statement on their worth and financials. This is a good thing because their shareholders can see if they had a good year or bad year and if their overall net worth is growing. However as householders, we don't really put this on ourselves. Shouldn't we at least try once a year to spend time working out just how much we are worth to see if this value is falling or going higher.

Question Four: How much money do you spend a month? No, really?

Do you as a household track your monthly outgoings? Do you keep all your receipts so you can tally up each dollar? Or do you just keep spending until the bank balance gets low? To run an extremely good budget, you need to know where each dollar is going.

If you are spending more than you bring in each month, long-term this will catch up with you. But how do you know unless you track it? The key to any happy household is to spend less than they bring in. But you need facts to determine if you are doing this. There is no use trying to guess this.

You would be surprised how many people tally up their total monthly outgoings only to realise they are spending more than they made. They make up the difference with credit cards, personal loans, and interest free deals.

What's your grade for this question? If it is a low one, our advice is to start doing this ASAP. You might have a rude shock awaiting you!

Question Five: What is your partner doing right now?

Some families operate from a joint bank account. However a big proportion operate single accounts. Let me assure you, if your partner gets into financial trouble, even without you knowing or approving it, this is your problem too.

The number of times we have heard of one partner opening a credit card up, without the other partner knowing is incredible. They're running up debts in both your names. The excuse, "I didn't know what he/she was doing" will not hold up in court. You are both responsible.

You have to treat your marriage like a plane with two wings. Both need to be present to fly. And both partners need to have a good understanding of what the other is doing. This not only protects you, but your family unit.

Right this very second as you are reading this, can you answer how many credit cards your partner has? What are the balances? This is not about going and accusing your partner of wrongdoing. However you need to be open and discuss exactly where you both are financially. Only then will you know your true wealth.

- If you can recognize the symptoms of depression and admit to yourself that you may be suffering from it, you have just taken the first step to beating this

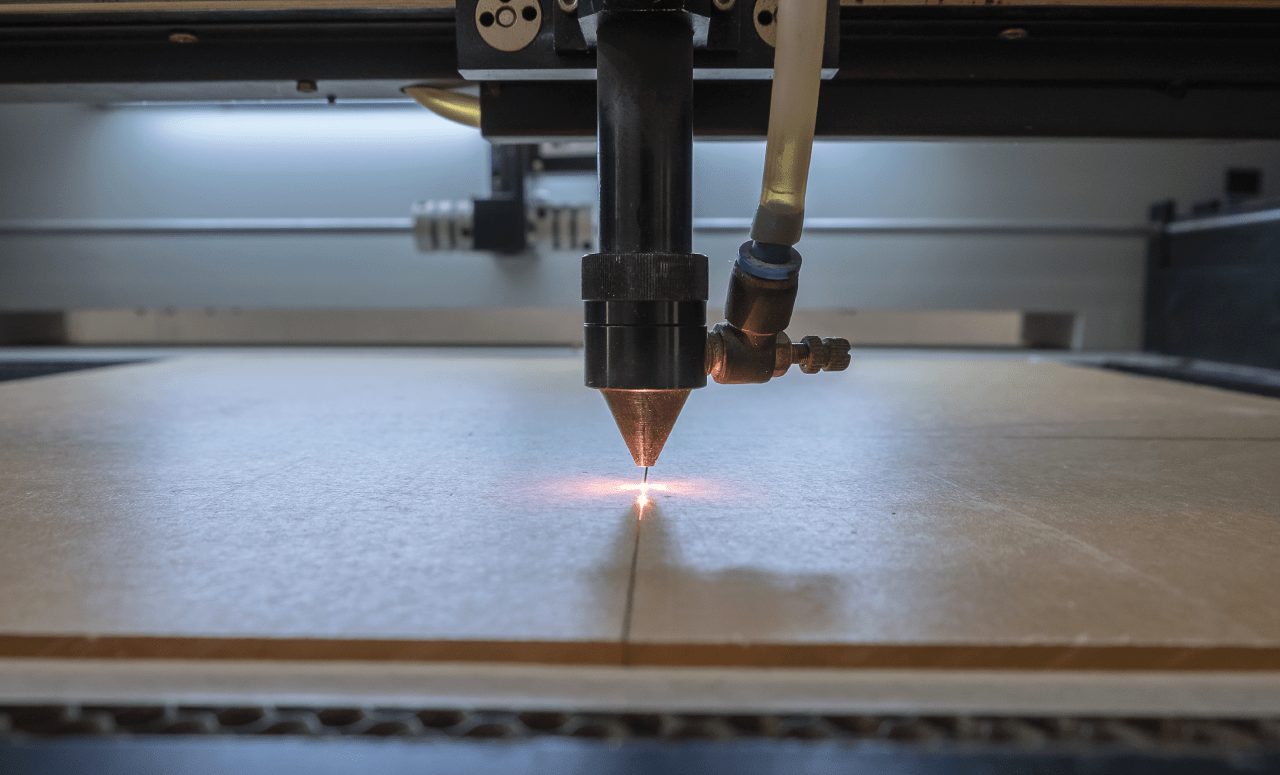

- Here in this article you can find the collection of the best laser cutter in 2021. Check details about every products and choose the best.

- From our professional to personal routine, many gadgets are always required handy to keep up with all sorts of tasks.Educating is one of the few professions the

.jpg)

- Credit (from Latin credit, “(he/she/it) believes”) is the trust which allows one party to provide money or resources to another