At the 2019 Sika Capital Markets Day being held in Zurich today, CEO Paul Schuler presents the new Strategy 2023, which builds on the current successful growth model. This will set the course for an even stronger performance. In addition to a rise in the long-term EBIT target to 15-18%, the main new elements of Strategy 2023 are the introduction of a new Target Market, “Building Finishing”, a focus on operational efficiency, and a targeted, Group-wide emphasis on environmentally friendly products and sustainability.

“We are convinced that Strategy 2023 will enable us to raise Sika to the next level and to continue on the growth trajectory we have successfully pursued for many years. With our newly established eighth Target Market “Building Finishing” we will be bundling our range of services and skills in the mortar technology field, thus focusing on the potential in this market. Increased focus on raising operational efficiency will help us improve our operating costs by 0.5 percentage points per year. On top of that, we want to make our product innovations even more sustainable while at the same time boosting product performance.”

Paul Schuler, CEO

The Sika growth model is synonymous with long-term success and profitable growth. By targeting the six pillars of market penetration, innovation, operational efficiency, acquisitions, strong corporate values, and sustainability, Sika plans to grow by 6-8% a year up to 2023. At the same time, it is aiming for a higher EBIT margin of 15-18%, instead of today’s 14-16%.

The company’s innovative power will increasingly be channeled into sustainable product development. New products will create clear added value for customers as well as being even more sustainable. 25% of sales will be generated by products that are less than five years old.

An important driver for margin improvement will be increased operational efficiency. Projects in the areas of operations, logistics, procurement and product formulation will result in an annual improvement in operating costs equivalent to 0.5% of sales.

Sustainability is a key value and a central element of Sika’s corporate management. Already today, Sika offers its customers a range of environmentally friendly product technologies, for instance for energy-efficient construction and environmentally friendly vehicles. In future, Sika products will not only deliver better performance but will feature enhanced environmental benefits as well. Furthermore, Sika has set itself ambitious goals to reduce its annual energy and water consumption, as well as its waste output. With its newly defined sustainability targets, Sika will minimize resource consumption and the environmental impact of its production process. Sika’s overriding goal is to reduce CO2 emissions per ton manufactured by 12% until 2023.

The successful implementation of Strategy 2023, with its sustainable and profitable growth and innovative solutions for products in all Target Markets, will secure Sika’s future. It will generate added value for all stakeholders, customers, and employees.

▪ In the first nine months: sales growth of 2.6% in local currencies

▪ Strongly negative currency effect of –6.0%

▪ EBITDA margin increased to 18.5%

▪ Over-proportional EBIT growth and increase in operating profit margin (EBIT) to 13.7%

▪ Operating free cash flow remains strong and exceeds prior-year figure

▪ Completion of acquisition of Adeplast (Romania), takeover of Modern Waterproofing Group (Egypt), and construction of new factories in Barranquilla (Colombia) and Chengdu (China)

▪ Outlook for 2020: For the fiscal year 2020, Sika is expecting slightly lower sales in CHF but EBIT broadly in line with last year, implying an over-proportional rise in EBIT in the second half.

▪ Confirmation of 2023 strategic targets for sustainable, profitable growth

Sika maintained its growth trajectory over the first nine months of 2020 despite the severe repercussions of the coronavirus pandemic, increasing sales by 2.6% in local currencies to CHF 5,805.5 million. The effect of acquisitions contributed 9.2% to the growth in sales. At –6.6%, organic growth in the first nine months of the current year was in negative territory. A strongly negative currency effect

(–6.0%) caused sales in Swiss francs to decline by 3.4%; the latter figure reflects a currency loss of around CHF 357 million.

Paul Schuler, Chief Executive Officer: “The 2020 financial year to date has been dominated by the coronavirus pandemic. With our decentralized organization, we have been able to adapt swiftly to changed local conditions in all 100 countries and gain market share. Thanks to our clear focus on innovations and sustainability and the business potential that we can exploit through global infrastructure programs, as well as to the increased demand for renovation work and our strength in the builders’ merchant business, we will be able to keep Sika on its growth trajectory and emerge from this crisis stronger than before. With our future-oriented solutions, we are the market’s prime mover and enable sustainable construction and mobility.”

EXPANSION OF GROSS MARGIN, STRONG EBIT PERFORMANCE

In the first nine months of the year, Sika was able to increase its gross margin to 54.6% (previous year: 53.5%). Lower sales in the months of March, April, and May had a negative impact on profitability, however. Nevertheless, operating profit before depreciation and amortization (EBITDA) increased, exhibiting a margin of 18.5% (previous year: 17.3%). The operating profit margin rose to 13.7% (previous year: 13.4%). Operating profit (EBIT) therefore amounted to CHF 797.4 million (previous year: CHF 805.9 million). The currency effect over the first nine months was negative at –6.0% and reduced EBIT by CHF 48 million. When viewed in isolation, an EBIT margin of 17.7% was achieved in the third quarter.

![1Z0-819 Questions [2021] Get 100% Actual 1Z0-819 Questions and Answers PDF](https://img.dreampirates.us/04-05-2021/4168discount 1.jpg)

- Prepare yourself with the Java SE 11 Developer Exam dumps following the actual Oracle exam material preparation. 1Z0-819 Questions

- Prepare yourself with the Certified Jenkins Engineer Exam dumps following the actual CloudBees exam material preparation.

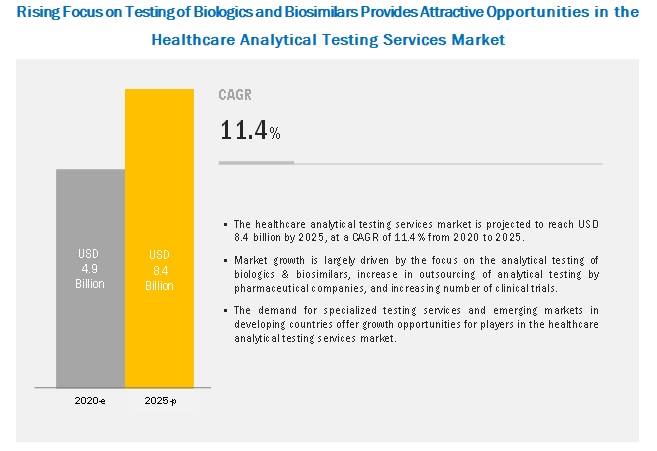

- Healthcare Analytical Testing Services Market Size Estimation and Analysis of Wide Range of Growth Opportunities for Industry Players.

- harder to make a deal and convince someone you deserve a better price on a vehicle if you are draped in expensive clothing. While you want to appear neat and ct