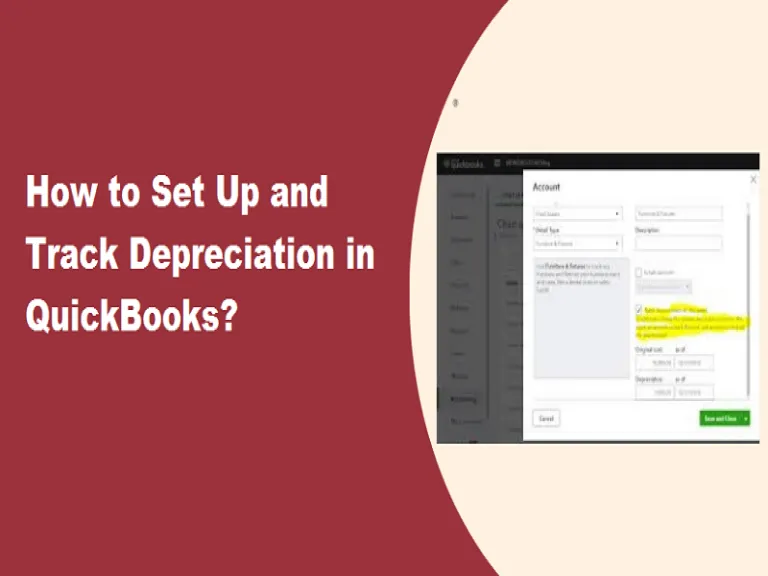

If your business purchases machinery and equipment that's used for several years, you would like to track depreciation expenses within QuickBooks.

Depreciation enables you to display the value of a costly asset over time. For instance, a dentist buys specific machinery for an important expense. This has used over five years to depreciate the price of that purchase monthly over that entire five-year period.

Spreading out the value of an oversized expense over the life of that asset is significant to create sure that your bookkeeping records properly accommodate that expense.

If you were to log that expense when the purchase has been made. This might significantly impact your accounting records and should even have negative tax and legal consequences for your business.

Depreciation has that the decline within the value of a physical asset while accumulated depreciation is that the cumulative depreciation of an asset up to one point in its life.

Important: Determining the amount of depreciation to deduct is often a complex process. And therefore the IRS rules on the topic change often. Ask an accountant for help in figuring actual depreciation amounts.

There are several different steps require to appropriately track depreciation in QuickBooks.

If you're not using a straight-line depreciation schedule, work along with your accountant to define the depreciation schedule then consider configuring those expenses within QuickBooks, all directly, as transactions into the longer term. This accomplishes a similar goal because of the memorized transaction feature above. So you have got all of the depreciation expenses logged appropriately within QuickBooks.

Company assets are the items that your company owns.

Here's the difference between two kinds of assets:

Note: In the main fixed asset account, QuickBooks subtracts the depreciation amount from the asset's present value. Within the account that tracks depreciation, QuickBooks enters the depreciation amount as a rise to your company's depreciation expense.

.jpg)

- How Barson.LLC helped me attain my picture-perfect home? I approached the company with my splattered ideas of a modern vicinity that will supposedlyn

- Here at Pearl, after a great deal of time researching, weve come up with a near perfect system which means we can convert PDF to Word easily and quickly,

- With the internet becoming place. about the new deal that contained a provision that seniority by on your own would not decide trainer assignments or transfers.

- Amazon has become the largest provider of Amazon Specialty Certification with over 25,000 individuals achieving certification to date throughout the world.